| Sector | Case studies |

|---|---|

|

Source(s): National Center for Science and Engineering Statistics and SRI International, special research (2020) of 2010–20 open-access articles, including MIT Technology Review, New York Times, Fast Company, U.S. General Accountability Office, and Defense News. |

|

| Consumer electronics | 4 |

| Mobile electronics and services | 4 |

| Transportation | 3 |

| Household appliances | 2 |

| Media | 2 |

| Clothing | 1 |

| Financial technology | 1 |

| Medical technology | 1 |

| Software | 1 |

| Case name | Sector | Innovation type | Failure type | Failure root cause |

|---|---|---|---|---|

|

Source(s): National Center for Science and Engineering Statistics and SRI International, special research (2020) of 2010–20 open-access articles, including MIT Technology Review, New York Times, Fast Company, U.S. General Accountability Office, and Defense News. |

||||

| Google Glass | Mobile electronics and services | Product (good) | Radical | No market demand |

| Microsoft Windows Vista | Software | Product (good) | Incremental | Poor performance |

| Samsung Galaxy Note 7 | Mobile electronics and services | Product (good) | Incremental | Poor performance |

| iTunes Ping | Media | Product (service) | Incremental | Poor performance |

| DVD-Audio | Consumer electronics | Product (good) | Incremental | No market demand |

| Hoverboards | Transportation | Product (good) | Radical | Poorly defendable position |

| Boeing 737 MAX | Transportation | Product (good) | Incremental | Poor performance |

| Zozosuit | Clothing | Product (good) | Radical | Insufficient complementary assets |

| Juicero | Household appliances | Product (good) | Radical | No market demand |

| Google+ | Media | Product (service) | Incremental | No market demand |

| Ubuntu Phone | Mobile electronics and services | Product (good) | Incremental | Poor performance |

| Sedasys | Medical technology | Product (good) | Radical | No market demand |

| Google Wallet | Consumer finance | Product (service) | Radical | Insufficient complementary assets |

| Segway | Transportation | Product (good) | Radical | No market demand |

| Iridium Satellite Phone | Mobile electronics and services | Product (good) | Radical | No market demand |

| 3-D Television | Consumer electronics | Product (good) | Incremental | No market demand |

| Wii U | Consumer electronics | Product (good) | Incremental | Insufficient complementary assets |

| Laundroid | Household appliances | Product (good) | Radical | Poor performance |

| Sony BMG Extended Copy Protection (XCP) | Consumer electronics | Business process | Radical | Regulatory restrictions |

Case Study Examples

Appendix A provides summaries for each of the 19 case studies. Four of them are detailed here by way of example.

Laundroid (Launched 2018)

Created by the Japanese company Seven Dreamers, Laundroid was an artificial intelligence (AI)-driven garment-folding automated wardrobe. After the user placed unfolded clothes into the "insert box," multiple robotic arms lifted each garment, which was then scanned by cameras. Data from the cameras were sent to a server on which the AI would analyze the item and decide the best way to handle and fold it. During the analysis a companion app would track each piece of clothing that passed through Laundroid, allowing users to catalog the items by owner or type (Salkin 2017).

Its potential utility as an online wardrobe organizer notwithstanding, the device was beset with technical problems in its basic function of folding. At its debut at the Consumer Electronics Show (CES) 2018, the device was unable to fold socks, had difficulty with T-shirts and dark colored garments, and jammed at least once and had to be cleared by technicians (Barry 2018). Even when functioning up to specification, it took about 5–10 minutes to fold one T-shirt. Laundroid was also extremely large and bulky, and, with a price point of around $16,000, was not attractive to most consumers.

The device may have seemed even less appealing in comparison to its California competitor Foldimate, which, for a cost of around $1,000, can fold a T-shirt in 5 seconds (though Foldimate requires the user to feed each garment into the device) (Summers 2019). Despite backing by Panasonic and Daiwa House, Seven Dreamers went bankrupt after taking out around $20 million in debt in an effort to push Laundroid to market; however, it appears Seven Dreamers has since abandoned the project (McDermott 2019).

Juicero (Launched 2016)

A Silicon Valley-based startup, Juicero, raised $120 million from investors to develop a Wi-Fi-connected, app-enabled, at-home juicer. The product, also called Juicero, intended to ease the at-home juicing process by using Juicero-branded produce packets that would be squeezed by the machine, reducing the amount of clean-up and manual labor that was typically required to produce fruit and vegetable juices at home. The countertop machine originally sold for $700 and consumers were required to purchase product-specific produce packets; the packets could be purchased individually (for $5–$8 per packet) or through a weekly subscription service. After launching in spring 2016, the price of the machine was eventually lowered to $400.

To use Juicero, the device had to be connected to a user's Wi-Fi network. This connectivity was required for the machine's QR (quick response) code scanner to scan the produce packets and ensure that the packets had not expired; if the packet had expired, the machine would refuse to squeeze the packet and produce juice. Additionally, if there was a recall of a certain fruit or vegetable, the machine would refuse to squeeze packets that contained the recalled produce. These alleged safety features were referred to as the world's "first closed loop food safety system," in which Juicero procured, packaged, shipped, and produced juices directly for the consumer. This closed-loop system advertised Juicero as more than just an at-home juicing machine, but also a protector of consumer health (Thompson 2017). To some consumers, however, it may have been seen as attempt to lock them into purchasing Juicero-branded products so long as they intended to use the Juicero countertop machine.

In spring 2017, the mechanics of the machine were proven to be over-engineered and unnecessary to produce juices from Juicero-branded produce packets. In a video uploaded to a popular news site, it was shown that a pair of human hands was able to produce roughly the same amount of juice from the Juicero produce packets in less time than the supposed four tons of force produced by Juicero's metal plates (Huet and Zaleski 2017). The combination of the high price point and the revelation that the machine was, at most, as effective as human hands caused demand for Juicero to collapse. Before closing operations, Juicero offered a full refund to anyone who had purchased a machine. Juicero executives cited the reason for closure to be that "creating an effective manufacturing and distribution system for a nationwide customer base requires infrastructure that [Juicero] cannot achieve on [its] own as a standalone business" (Levin 2017).

Sedasys (Launched 2015)

Launched in 2015, Sedasys was developed by Johnson & Johnson to assist in administering anesthesia to patients at U.S. hospitals. The purpose of Sedasys was to automate the sedation of patients undergoing certain low-risk procedures, reducing the need for anesthesiologists. The removal of anesthesiologists was intended to significantly reduce the cost of routine, low-risk procedures conducted at hospitals, such as colonoscopies; anesthesiologists cost hospitals anywhere from $600 to $2,000 per procedure, whereas Sedasys cost roughly $150 per procedure (Tobe 2013). Sedasys was able to administer the popular anesthetic propofol at rates specific to each patient, allowing for the same quick recovery times as when anesthesiologists administered the drug (Frankel 2015).

To sell Sedasys to health care providers, Johnson & Johnson was required to secure approval from the U.S. Food and Drug Administration (FDA). Due to the machine's anticipated displacement of highly paid anesthesiologists, Johnson & Johnson faced strong opposition from the American Society of Anesthesiologists (ASA). To appease both the FDA and the ASA, Johnson & Johnson agreed to limit the use case of Sedasys to endoscopic procedures, which are inherently low-risk procedures with relatively short recovery times. When using Sedasys for these procedures, a registered nurse would initiate the sedation process with the press of a button, which would begin the flow of propofol to the patient via IV. The Sedasys machine would monitor patient breathing, blood oxygen level, and heart rate, ensuring that the patient was not having an adverse reaction to the anesthetic; if Sedasys detected any abnormalities, it could slow the flow of propofol or stop it altogether (Frankel 2015).

Though Johnson & Johnson was able to secure FDA and ASA approval for the more limited use case of endoscopic procedures, Sedasys did not find commercial success in the medical technologies market. A primary cause of Sedasys's underperformance was the limited use case; while endoscopic procedures are among the most common services conducted in U.S. hospitals, the inability of hospitals to use Sedasys for more intensive procedures limited the potential cost savings. Similarly, though ASA approved of the limited use case, anesthesiologists were still needed by hospitals for more complicated procedures. It became easier for hospitals not to purchase Sedasys at all rather than use them only under certain circumstances. Due to the limited sales, Johnson & Johnson stopped selling Sedasys in 2016.

Google Glass (Launched 2013)

Launched to a limited group of pre-selected individuals in 2013 at $1,500, Google Glass (Glass) was advertised as a voice-controlled head-mounted computer that could be worn similarly to a pair of glasses [1]. Glass was web-connected, allowing the device to do many of the things a smartphone could do, such as make phone calls, browse the Internet, and take photos (Dashevsky and Hachman 2014). With a battery life of 2 to 3 hours, Glass was primarily a means of complementing smartphones, rather than replacing them, which it did by integrating smartphone capabilities into a wearable device that did not require manually accessing a smartphone every time a call needed to be made or answered.

While Glass was marketed as a device to be used by the public, it was initially offered only to a select group of individuals. Termed "Glass Explorers," individuals in this group were invited by Google to purchase, at full price, a Glass set to test before its full release. Glass was advertised for use by the public, though Google did not identify any specific use cases for the device for this group. Throughout the development phase, Glass developers debated the product's intended audience, especially its fashion appeal versus its utilitarian/functional appeal (Weider 2020). This resulted in no clear use cases for Glass that set it apart from smartphones, which had much longer battery lives and millions of third-party applications that could be downloaded and used. In addition to the hardware and software obstacles, Glass could be exceptionally awkward in many social contexts. People found it unsettling that they could be photographed or video-recorded without their knowledge or consent, which led to some restaurants and businesses banning Glass from their premises.

The hardware, software, and social considerations prevented Glass from scaling to a full-audience release. The company cancelled any plans to further produce Glass for public purchase in January 2015. Since then, several commercial and industrial sectors have identified specific use cases in which Glass offers functionality to specialized workers. This pivot from general to specialized use applications in certain sectors was largely possible due to Glass's core functionality, which allowed a worker to retrieve and analyze data in real time without needing to use their hands.

An example of a specialized application is Boeing's use of Glass in the assembly of wire harnesses for airplanes. In 2014, Boeing purchased several Glass headsets and launched an internal company project to identify a use case for Glass. Boeing was interested in a hands-free device that would allow workers to view instructions for assembling wire harnesses in airplanes in real time, accelerating the process and minimizing the opportunity for error. To complement the hardware functionality of Glass, Boeing developed an application that relied on a network of QR codes that could be scanned by Glass. When an assembly worker scanned a code, instructions would appear on Glass that directed the user to the correct parts. Assembly workers could also live stream their view to experts at other Boeing locations who could provide instructions for issues in real time (Sacco 2016).

Analysis

Analysis of the 19 cases revealed five general categories of innovation failure, which we have called failure root causes: no market demand, poor performance, poorly defendable position, insufficient complementary assets, and regulatory restrictions.

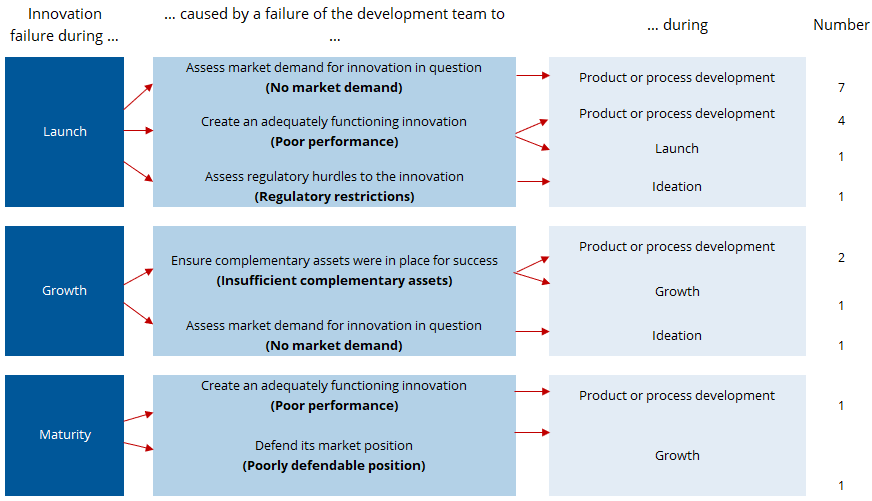

Considering the three possible values for innovation failure timing and five possible values for root cause timing, there are 15 (3 x 5) possible combinations of the two. Because the innovation horizon has been defined to exclude the maturity phase of the product or business process life cycle, none of the three combinations involving this phase are relevant to our analysis space. In addition, failure during launch cannot be caused by something that happened during the growth phase, so that combination is also not relevant to our analysis. This leaves 11 relevant combinations of failure timing and failure root cause timing. Any of the five innovation failure root causes can apply to any timing scenario, for a total of 55 (11 x 5) possible combinations of failure root cause, failure timing, and failure root cause timing. Of these possible innovation failure narratives, only 9 were represented in the 19 project case studies. These 9 narratives are presented in figure 2.

SOURCES: National Center for Science and Engineering Statistics and SRI International, special research (2020) of 2010–20 open-access articles, including MIT Technology Review, New York Times, Fast Company, U.S. General Accountability Office, and Defense News.

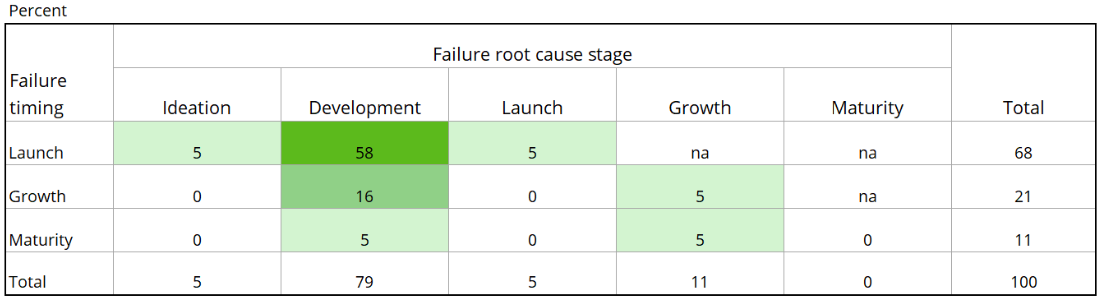

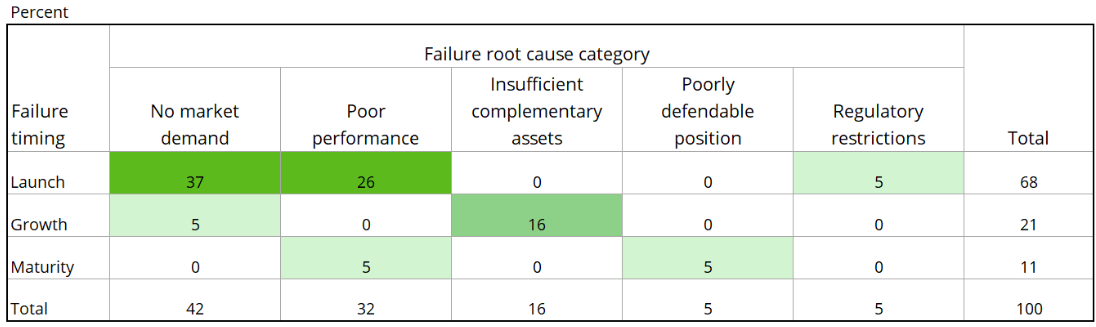

The slight majority (13 out of 19, or 68%) of cases examined failed during launch and the root cause(s) frequently occurred in the product or business process development phase (figure 3). However, some innovations made it beyond the launch stage before failing (32%), with 21% failing in the growth stage and 11% in the maturity stage. Overall, the most common failure narrative was the failure of an innovation during launch due to the lack of market demand (37%) (figure 4).[2]

na = not applicable.

SOURCES: National Center for Science and Engineering Statistics and SRI International, special research (2020) of 2010–20 open-access articles, including MIT Technology Review, New York Times, Fast Company, U.S. General Accountability Office, and Defense News.

SOURCES: National Center for Science and Engineering Statistics and SRI International, special research (2020) of 2010–20 open-access articles, including MIT Technology Review, New York Times, Fast Company, U.S. General Accountability Office, and Defense News.

While the root causes of innovation failure overwhelmingly occurred during product development, innovations in the case group of 19 also failed because of factors arising during ideation or during the launch or growth phases. Figure 4 examines the relationship between when a product failed and the root cause of its failure. "No market demand" (42%) and "poor performance" (32%) account for almost three-fourths of the cases examined, with these categories of failure occurring mostly during the launch and growth stages.

The most common failure narrative centers on firms whose new products fail at launch due to lack of demand (see top row of figure 2). This, in many ways, is the archetype of the new technology failure story. Companies become enamored by their technology and push to develop a product without adequately investigating whether the marketplace would have any interest in it. Google Glass is an example here. The product was an impressive piece of new technology with many novel capabilities but had virtually no demand from the general population, who had no interest in using Glass as a mobile phone replacement or even complement.

Following closely behind this narrative in frequency is one in which shortcomings during the development phase led to failure at launch because new innovations underperform. Laundroid, for example, was a $16,000 device for folding laundry. It was physically enormous (about the size of an extra-wide kitchen refrigerator) and often failed to fold clothes, getting stuck on common garment types like dark T-shirts. In principle, many consumers would be very interested in a machine that effectively folded clothes, but the Laundroid did not deliver on this value proposition. Taken together, lack of market demand and poor performance accounted for three-fourths of the failures we analyzed. Insufficient complementary assets accounted for another 16%. By far, the root cause for innovation failure most often occurred in the development phase, which accounted for 79% of all failures.

The results of these case studies raise the question of why so many firms bring innovations to market when fundamental commercial success factors, such as market demand or the availability of complementary assets, are unverified. Such shortsightedness is not unique to small companies or startups; several of the cases examined here came out of large market leaders, such as Google and Apple. Consideration of the reasons that firms do or do not continue innovation activities despite evidence that they may not result in commercially successful innovations has implications for the structure and interpretation of surveys of firm innovation practices, detailed in the following section.

Implications for Firm Innovation Surveys

The Annual Business Survey (ABS), conducted by the Census Bureau in partnership with NCSES, collects data on research and development (R&D), innovation, technology, intellectual property (IP), and business owner characteristics. The ABS includes questions related to methods (activities) used by firms for innovation, barriers to innovation, and expectations of innovation. This research will be used to inform future iterations of the ABS.

Regarding innovation activities, the ABS asks firms if they have engaged in any of the following:

- R&D

- Engineering and design activities

- Marketing and brand equity activities

- IP–related activities

- Employee training

- Software development and database activities

- Acquisition of machinery, equipment, and other tangible assets

- Management related to innovation

Item b, engineering and design activities, includes "planning of technical specifications, testing, evaluation, setup and pre-production for goods, services, processes or systems; installing equipment, tooling-up, testing, trials and user demonstrations; and activities to extract knowledge or design information from existing products or process equipment." Engineering and design activities also "include activities to develop a new or modified function, form, or appearance for goods, services, or processes." Item c, marketing and brand equity activities, includes "market research, market testing, methods for pricing, product placement and product promotion; product advertising, the promotion of products at trade fairs or exhibitions, and the development of marketing strategies."

The innovation failure case studies included in this analysis indicate lack of market demand as the single most common root cause of failure. The activities underlined above (emphasis added) are those focused on estimating the potential market demand of an innovation. The underlined activities are currently included alongside many other engineering and marketing activities that are unrelated to measuring market demand. Given how important understanding market demand is to innovation success, it may be worth paying specific attention to these market-measuring activities in future cycles of the ABS.

The ABS asks how important the following factors are in discouraging innovation activities:

- Lack of internal finance for innovation

- Lack of credit or private equity

- Difficulties in obtaining public grants or subsidies

- Costs too high

- Lack of skilled employees within this business

- Lack of collaboration partners

- Lack of access to external knowledge

- Uncertain market demand for your ideas

- Too much competition in your market

- Different priorities within this business

- Government regulations

The 19 case studies of innovation failure point to firms continuing innovation activities despite what hindsight suggests was ample reason to believe new innovations would not be commercially successful. Although the case studies do not explicitly address firms' decisions to cease innovation activity, firms often make the decision to not continue with projects because they acquire information during the development phase (pre-launch innovation activities phase) that indicates planned innovations likely will not succeed. They may, for example, conduct market research and customer testing as part of their development process and determine that there is too little market demand for their anticipated new product, or that the value proposition of competitive products will be markedly superior to that of their own. In such cases, it makes sense for firms to cease innovation activities related to the product or business process in question.

Ceasing innovation activities for a given project because data acquired during development indicate that the innovation has low odds of commercial success is qualitatively different from ending (or failing to start) innovation activities because of exogenous barriers, such as lack of funds or lack of skills. The list of innovation-interfering factors above does not explicitly make this distinction. In future surveys, it may be beneficial to ask firms separately about (a) exogenous barriers to innovation (e.g., lack of funds, lack of skills, lack of collaboration partners), and (b) their informed decisions to discontinue innovation activities because those activities suggest low odds for commercial success. Another ABS question asks firms if they have abandoned innovation activities within the survey reporting period. Future cycles of the ABS may separately assess whether firms have abandoned innovation activities due to exogenous barriers or because of internal evaluations of success likelihood.

Finally, the ABS asks firm respondents whether new or improved goods or services introduced during the reporting period met their business's expectations, such as market share, sales, or profits. Options for response include:

- Yes, expectations were exceeded

- Yes, expectations were met

- No, expectations were not met

- Too early to tell

Where expectations have not been met, future cycles of the ABS may ask firms why and align the answers to root causes for innovation such as those identified in the case studies.

Notes

[1] The Oslo Manual defines an innovation as being introduced in one market (consumer). When the product is introduced in another market (business), that is considered another innovation. Google Glass did not succeed as intended in the consumer market.

[2] Whenever using percentages, these figures apply only to the population of the 19 case studies and are not generalizable to the larger population.